Embedded finance is undoubtedly a hot topic in the Fintech industry and offers an incredible opportunity, with predictions that it will reach a market size of $588 billion by 2032. The concept of integrating financial services into non-financial offerings can provide value to all stakeholders involved. Consumers can benefit from a frictionless and optimized experience, brands can create an additional revenue stream, and Fintechs can gain an effective distribution channel.

With the rise of Gen AI and the commoditization of models, tailoring personalized products and experiences for specific audiences is becoming more achievable than ever. But the key to building companies that are efficient at scale is nailing down the distribution. Embedded finance, if correctly executed, can enable fintechs to ultimately reduce their distribution costs down to practically zero.

However, despite the justified hype surrounding embedded finance, it has yet to deliver on its game-changing potential, at least in its current form. Most existing use cases of embedded finance focus on the basic concept of distribution – incorporating one product within another product. While this approach does provide some value, the overall experience remains limited.

The First Generation: An Offer Without a Cause

The first generation of embedded finance has primarily centered around banking and payment applications. A wide variety of existing Infrastructure and BaaS startups can enable various applications in which one financial capability is embedded within another. However, in many of these use cases, integrating payment capabilities, for example, does not result in significant value for the customer. Often, embedding a payment product merely replaces an existing payment capability without offering anything new for the user. Though merchants may profit from a business perspective, customers remain indifferent as there is no added value or improvement in their experience. This type of add-on is more akin to integrated, rather than embedded finance.

Finance in Transition – From Embedded to Contextual

Offering Embedded Finance in practice entails integrating a new product that introduces fresh functionality within an existing product while staying within the same framework. For instance, services offering equity research and analysis can be seamlessly integrated into trading platforms.

This embedded product furnishes customers with an extra layer of information, enhancing their ability to make informed trading choices. Consequently, although it introduces added value or functionality, it remains within the original content domain. But the holy grail to creating the ultimate experience is in the intersection of embedded, personalized, and on-time. Or, in a word – contextual.

Contextual Finance can be best understood through the lens of intent. Often, purchasing a financial product is not the main objective of the customer but rather a secondary outcome that arises from another goal. For instance, someone doesn’t wake up in the morning with the desire to obtain a mortgage, but they might wake up with the desire to buy a home. This primary intent of purchasing a home drives their actions while getting a mortgage is a complementary intent that helps them achieve that goal. By considering the context and offering a financial product as part of the customer’s journey toward achieving his primary goal, Contextual Finance can deliver an embedded, personalized, and on-time experience.

The most disappointing examples of embedded finance space are instances where the user experience lacks context. One can understand the lack of context via the abundance of stories of retail giants attempting to offer their customers banking services. While they leverage their distribution power to offer an additional product that generates further revenue, the user journey simply lacks the accurate context to create sustainable value, and that departure from their core activity has a high likelihood of driving adverse outcomes. This type of likely adverse effect by lacking context might be the reason behind Tesco’s decision to sell its bank to Barclays earlier this year.

Let’s take a look at several interesting use cases of Contextual Finance.

1. Insurance

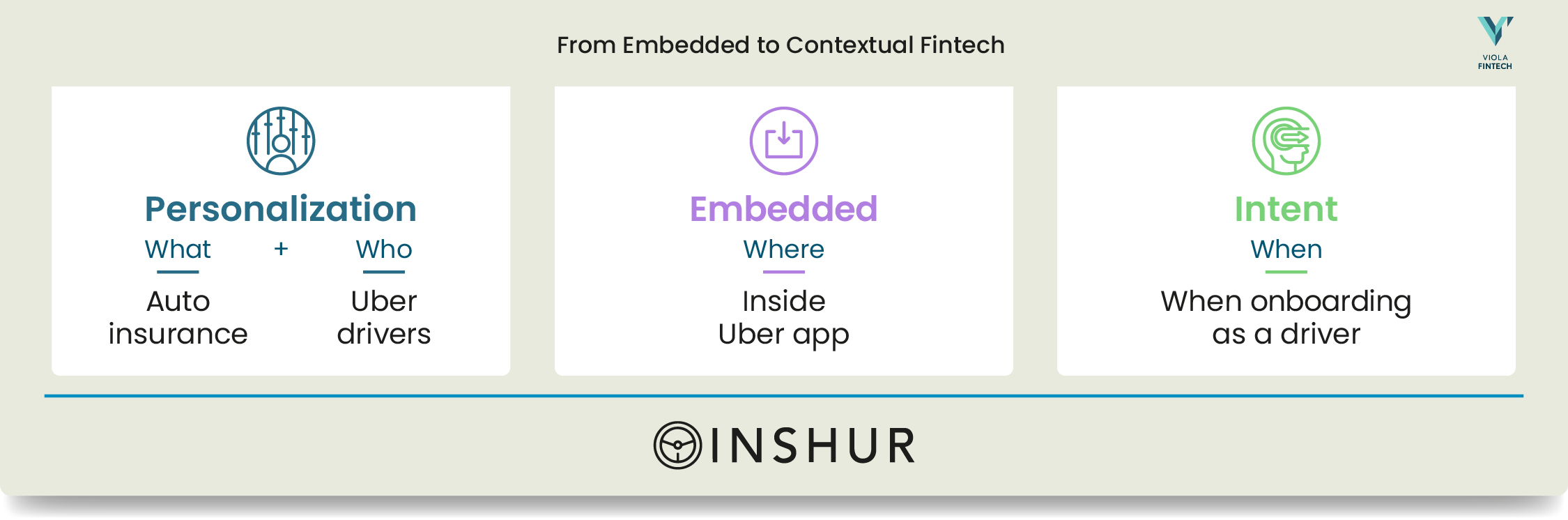

Insurance is one of the most exciting areas in terms of contextual finance. There are many use cases whereby customers are enabled to purchase additional protection for the product they initially intended to buy. Those aspiring to make a living or earn a few extra dollars by driving an Uber, for example, don’t first look for insurance, yet it’s the product that enables them to achieve that goal. Inshur, an offering built into the Uber app, offers insurance tailored to Uber drivers as they sign up, eliminating the research hassle and providing value to both sides at exactly the right time.

2. Earned Wage Access

Earned Wage Access is a form of financing against payroll designed to give employees more control and flexibility to build their financial well-being. There are many opportunities to inject context for both the employer and the employee. For hourly workers, the need is especially relevant, and ZayZoon offers a fascinating approach, embedding its services on payroll and timekeeping platforms, enabling it to offer access to advanced wages based on specific behavioral patterns such as clocking in fewer hours in a particular week or month.

3. Financing

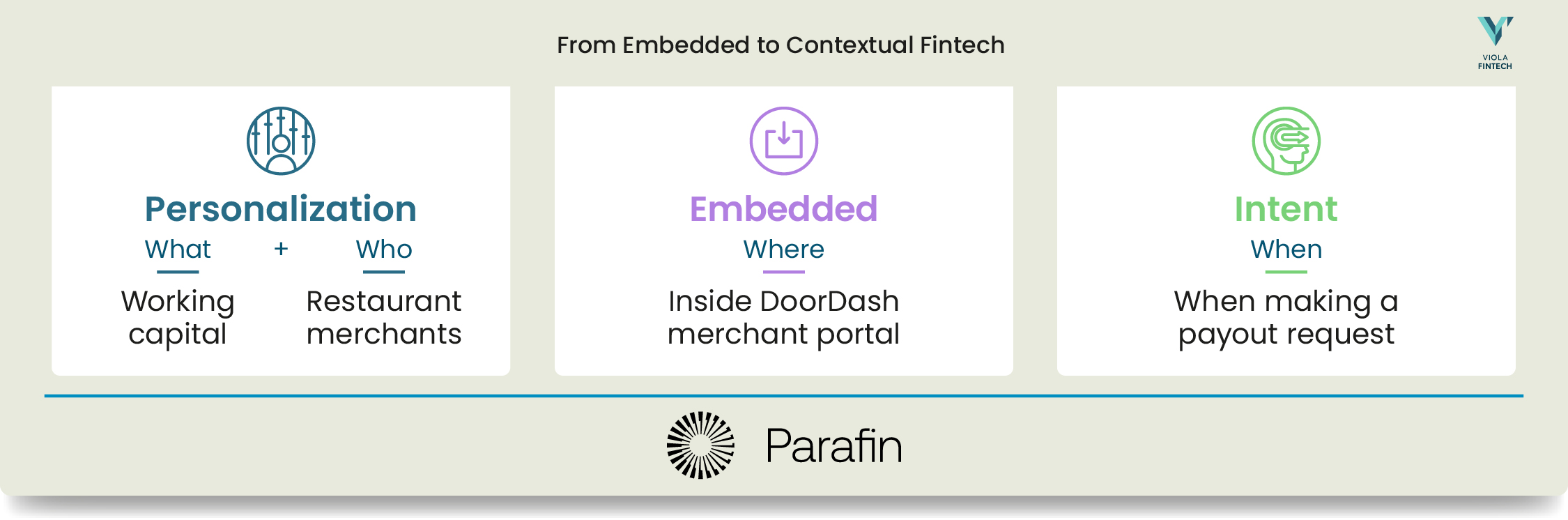

The lending space holds a myriad of opportunities for contextual finance. Intuitively, we’ve defined use cases of Buy Now Pay Later [BNPL] or financing offerings within the checkout that help drive the purchasing decision as contextual, while post-transactions use cases of net-terms financing within invoice and bill pay are more suitable for the definitions of embedded. Parafin stands out in this category as users with a primary intent of managing Doordash or Amazon activity are offered cash flow when making a payout request.

4. CFO Stack

The CFO stack includes diverse solutions for managing finances, analyzing metrics, paying suppliers, and more. While the range of software types makes some use cases more difficult to contextualize than others, there is plenty of opportunity to introduce contextual solutions. A UK-based startup called Ember, for example, embeds accounting solutions within SMBs’ corporate bank accounts, so while checking finances, small business owners can intuitively access their cash flow analytics and move to take some accounting actions. While the solution is embedded as a separate tab that shows the customer’s cash flow and analytics, the premium offer of accounting and tax services is contextualized within that dashboard.

5. Banking

Most banking used cases in embedded finance fall under the category of infrastructure, simply connecting one financial institution to another relevant one. Still, use cases of contextualized banking are beginning to appear that are specialized and timely. Grain has a currency hedging solution embedded within corporate platforms such as travel booking, supply chain, shipping, marketplaces, etc., enabling companies to reduce FX exposure by hedging through their bank as part of the transaction flow.

6. Wealth

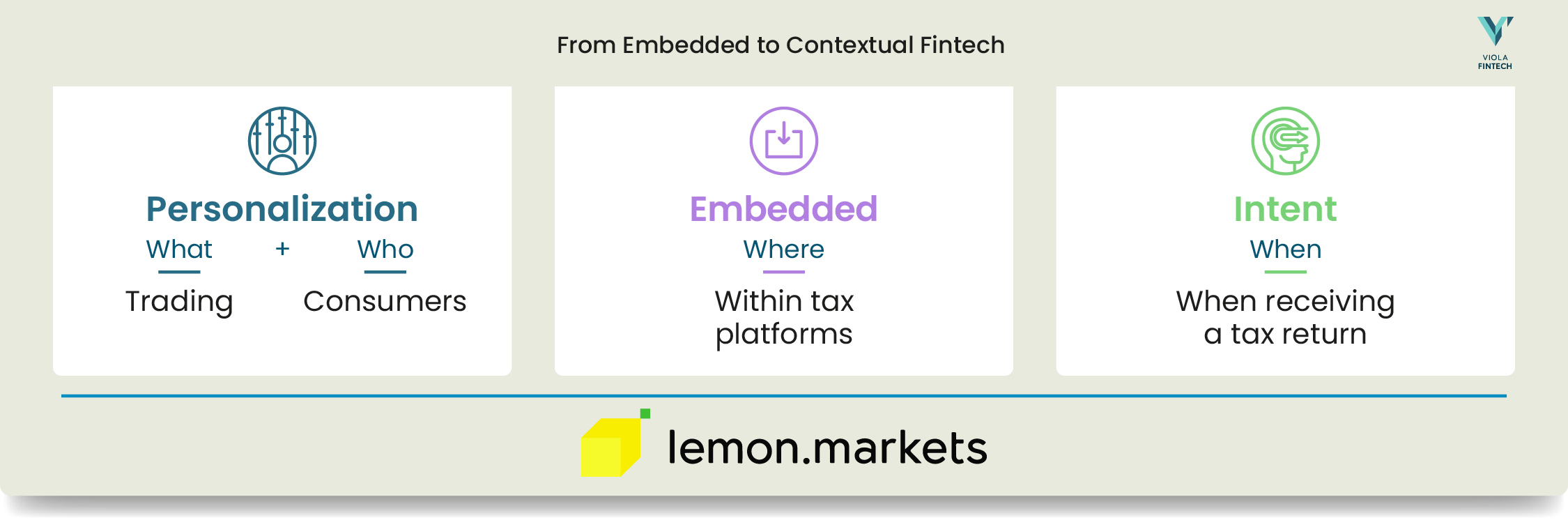

Embedded finance examples abound in this category, with relevant calls to action for investors to open up high-yield savings accounts, purchase research tools, or pursue options trading, just to name a few. However, the space has plenty of opportunity to transition from embedded to contextual, with companies such as Lemon Markets offering a great example. Lemon Markets’ vision is to be embedded within tax platforms and offer investment options after a specific event, such as receiving a tax return.

Offering Contextual Finance is More a Step Than a Leap

Contextual Finance refers primarily to the user experience whereby a necessary or complimentary product is added so the user can make a relevant, beneficial decision beyond their primary intent on a platform at the right moment. Any company that sells directly to consumers will benefit from an embedded strategy because of the low CAC, and naturally, a contextual strategy can make that distribution much more effective and streamlined. Jumping straight to contextual finance doesn’t require any significant leap; it simply requires planning the customer journey with the intent in mind to offer the right product at the right time.

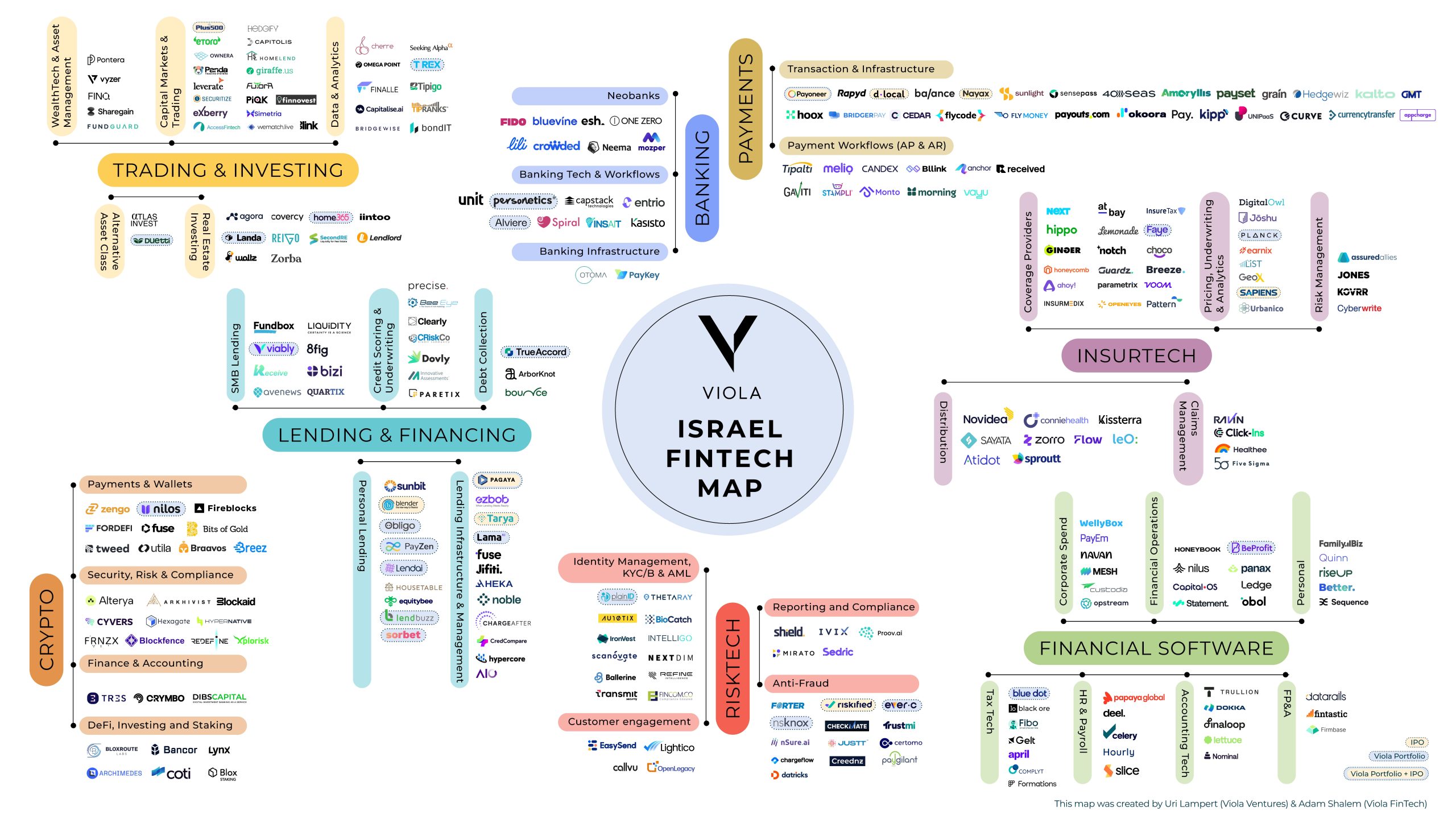

The Contextual Finance Map provides a comprehensive view of our perspective on the future of embedded finance. The Viola Fintech team has reviewed hundreds of companies and highlighted 120 of them according to their current activity and future vision, categorized into three categories: Infrastructure, Embedded, and Contextual.

● Infrastructure – Companies that provide infrastructure solutions with the flexibility to enable embedded or contextual use cases. These companies provide APIs that can be integrated in various ways – simply integrated to slightly optimize an existing functionality or in a more advanced experience as embedded or contextual.

● Embedded – Companies that provide a product that by being embedded adds a new functionality within the main product.

● Contextual – Companies that are providing or aspiring to provide a product that is embedded within a product from a different domain or industry, where the main focus is serving a complimentary intent that’s contextually linked to the primary intent.